Excellent Concepts For Making An Insurance Coverage Purchase

Insurance is important for everyone to have. Insurance, whether http://www.opm.gov/policy-data-oversight/employee-relations/employee-rights-appeals/ it is auto insurance, health insurance, life insurance, or property insurance, protects you in the case of unfortunate incidents that may threaten your health or livelihood. If you would like more information about insurance, then pay close attention to this article.

When you choose insurance for your car, qualify your insurer first. Besides evaluating coverage, it is also in your best interest to look for reviews on their customer service, claim responsiveness and even rate increases. Knowing who you are dealing with ahead of time can help you set expectations with your insurer.

Before renewing or purchasing insurance, you may be able to save money by getting new quotes. Insurance companies don't all use exactly the same criteria when calculating a premium. There's a large variation in the insurance costs in between the companies. Make sure you shop around and get different quotes before you purchase an insurance policy.

When involved in an insurance claim, always be as professional as possible. The people you are working with are people too, and you will see much more positive results if you are positive and professional. Your insurance company only wants to know the facts, not the emotions. Proofread all written material sent to them.

When purchasing insurance, make sure you buy it over the internet. Most insurance companies offer discounts for those who purchase set up business their coverage over the internet rather than in person or over the phone. Some offer discounts between 5-15%. It may not seem like a lot at first, but it adds up over time.

Before you choose an insurance policy, be sure to shop around so you know what your options are. There are many online services which can give you quotes from a number of different insurance companies, or you can hire a private insurance broker who can give you options and help you decide which is right for you.

In cases of regional disasters, some insurance companies will send special adjusters into the area to help expedite claims for policyholders, arrange temporary housing, and begin the rebuilding process. When shopping for a new homeowner's policy, you might wish to go with a carrier that has a history of helping out like this.

Bundle your home owner's or renter's insurance with your car insurance and you should save on overall costs. Don't buy insurance "a la carte." Most major insurance companies will offer significant cost-savings when you bundle different insurance policies under their umbrella. Shop around for the best deals and then make your purchase from one provider.

If you're planning on switching insurance providers, make sure you open your new policy BEFORE canceling your old one. If you cancel your policy first you could find yourself uninsured at the worst possible time, leaving you uncovered and paying for the situation yourself. Saving money isn't worth the risk!

To have the best relationship with your insurer, make sure to choose a company which is top-rated in the industry. It's one thing to get a deal, but it's another to have trouble with that company's customer service. Top-rated insurance companies will make the process of filing a claim or adjusting your insurance easy, and you can rely on them to help you in your time of need.

In order to get the best rates on insurance, you should choose the highest deductible you can afford. This can lower your rates by as much as 25%. It is important however that you would be able to cover the deductible amount in the event that something would happen to your home or auto.

Do not forget to check with internet only insurance companies, when searching for quotes. Many insurance companies have popped up online offering great savings over traditional insurance companies. These companies can afford to offer substantial discounts due to their lower overhead costs. Without having to pay agents, commissions, as well as, not having to deal with volumes of paperwork, they save lots of money, which is then passed on to you.

A yearly review of their insurance policies is a habit everyone should practice. Make sure that all information on your policy is correct and update it with any changes. Make sure you are receiving credit for such things as automatic seat belts on your automobile policy and security monitoring on your home owners policy.

You should know the different types of insurance available to you and whether you will need them or if they are required by the state you live in. For instance, most states require you have minimum coverages which vary in different states. Make sure you have the minimum coverage and no more unless you need it.

To make sure you get the coverage that's right for you, research the various types of coverage available. Educating yourself about coverage will make sure you don't pass up on anything you need, and will save you money on the things that you don't. Knowledge is power, and this knowledge gives you the power to get the perfect insurance plan.

Insurance is an investment you make in case of an emergency or disaster. From auto accidents to health problems, if you have insurance it can help you rest assured that you will be able to afford the damages incurred. Having that peace of mind can help you rest better knowing that whatever happens, it is covered.

If you submit an insurance claim and it is denied, always take the time to appeal the denial. At times insurance carriers initially deny a claim and then later are willing to reconsider the claim. Unless the circumstances of your claim are specifically excluded on your policy, appealing a denial can be well worth the time and effort.

The price is not the only thing that matters when trying to get a good insurance provider. You want to work with a person and company that is easy to work with as well as being rather responsive, so be sure to ask around and see who has had a good experience with their company.

Shopping around for insurance is your best bet no matter what type you may be seeking. Some companies may offer you a better deal if you combine services, but it can never hurt to take a little extra time. You may even be able to get a lower rate if you mention that company "x" offered you a certain price rate.

Insurance should not be neglected, even though it can be frustrating. You can use the information that has been provided to get the best price for the coverage you require. Compare and contrast policies in detail before deciding upon one.

What You Are Neglecting Concerning Insurance Coverage

A lot can go wrong in our lives, which is why we carry insurance policies. But how do you know you are getting the best deal or are covered in the ways that you need to be? Follow the tips and guidelines below to make sure that you are covered.

Check with organizations that you belong to and find out if they have a relationship with any insurance companies to obtain a discount. For instance, professional organizations and alumni groups sometimes partner with a certain insurance company to offer discounts to their members. This can result in savings for you.

Before renewing or purchasing insurance, you may be able to save money by getting new quotes. Insurance companies it contractor rates don't all use exactly the same criteria when calculating a premium. There's a large variation in the insurance costs in between the companies. Make sure you shop around and get different quotes before you purchase an insurance policy.

Much like car insurance or health insurance, having a higher deductible can save you money on your premium. The downside to all of this, is that if you have a small claim to make, you will most likely have to pay for the entire repair out of your own pocket.

If you want to save money, inquire about bundling your insurance. You could possibly combine your auto and motorcycle insurance policies under one joint fixed rate. Home insurance, or other useful insurance policies, may also be available for bundling. Take care to not purchase unnecessary insurance.

If you have filed a claim for a major loss, remember it's the insurance company's job to minimize that claim, but it's your job to get back what you lost. You may be fortunate to work with a trustworthy, principled company, but you should understand that you and the company are effectively at cross purposes and that you need to be an advocate for recovering your own loss.

If you have a home and a car, insure them through the same company to get major savings. Most insurance companies offer multi-policy discounts, meaning the more different policies you have registered with their company, the less you will pay for them overall. It is also more efficient to pay your bill.

Ask for quotes from several insurers and check online too. Be sure to include the same variables for accurate comparisons. You can choose to go with the lowest quote, assuming that the insurer has a good reputation for service and payment of claims, or you can bring the quotes to your present insurers to see if they will match the better rates.

If you are one of the millions of people who rent rather than own a home, investing in renter's insurance is a smart way to ensure that your personal possessions are covered in the event of fire, theft or other hazards, as well as to protect yourself from injury or property damage claims. Most renter's insurance covers the cash value of your possessions, taking depreciation into account, so make sure to upgrade to replacement cost if you want to be able to repurchase your items with no out-of-pocket expenses. Your policy should also include a personal liability clause to protect you from lawsuits if someone is injured in your home or the property is damaged because of your negligence. Talk with an insurance agent to find out all the specifics of a policy before making a choice.

You are likely to get a nice discount for having multiple policies with them. Get a quote from them and compare it with a few other companies and simply go with whichever one is cheapest.

If you have a smart phone, use it to your advantage to help handle your insurance. Some companies have specialized apps for several aspects of insurance issues. From home inventory assistance to policy management and bill reminders, you can find a program to download to your phone. Check with your carrier to see what they offer, if you can't find something in the app store.

When you decide to go shopping for a new insurance policy, make sure you're comparing identical coverage https://en.wikipedia.org/wiki/Employment_Rights_Act_1996 packages. You may find a low rate offered by an insurance company, but you have to ask them what kind of coverage you will be getting and what your deductible will be to ensure it is actually saving money while getting the same coverage you currently have. Being under-insured is just as bad as paying too much for your insurance!

A yearly review of their insurance policies is a habit everyone should practice. Make sure that all information on your policy is correct and update it with any changes. Make sure you are receiving credit for such things as automatic seat belts on your automobile policy and security monitoring on your home owners policy.

When shopping for coverage, make sure to get quotes from multiple insurers and for different plans within a particular company. The prices of insurance plans vary wildly and you could be missing out on saving hundreds of dollars a year by not shopping around. Consider working with an insurance broker, who can help you understand your various options.

Many people don't realize this but you can consolidate your insurance policies, such as your car and homeowner's insurance to the same company. Most insurance companies will give you a discount on both policies for doing this and you can save anywhere from 5% to 20% on your insurance just by doing this.

Check with your credit union, college sorority, and credit card companies to see if they work with a certain renter insurance company. If they do, you are likely to get some great discounts from the company on a renter insurance policy for your apartment that will save you a lot of money in premiums.

If you own health or term life insurance you should never let your insurance lapse. If you fail to extend your insurance for any reason, the insurance company may require you to submit to health exams, and you may not be able to get back your coverage at the same price if you are able to get it back at all.

The price is not the only thing that matters when trying to get a good insurance provider. You want to work with a person and company that is easy to work with as well as being rather responsive, so be sure to ask around and see who has had a good experience with their company.

Shopping around for insurance is your best bet no matter what type you may be seeking. Some companies may offer you a better deal if you combine services, but it can never hurt to take a little extra time. You may even be able to get a lower rate if you mention that company "x" offered you a certain price rate.

The knowledge you just learned about insurance is but just a bit of the whole you can learn. There is so much information to learn, but don't be discouraged by that. In order to make sure you make the right decisions always make sure you expand your knowledge, so come back to this article if necessary but make sure you learn other things as well and you should be successful in your insurance decisions.

Stop Paying Too Much For Insurance Coverage

Would you like to pay less for insurance? Many people pay way too much for their policies. By following these quick and easy steps, it is possible to pay less for your insurance needs. Paying less for insurance, and getting better rates, is something that many people would like to do. Follow these steps to reduce your costs.

Insurance companies will usually lower your premiums if you use them for your life, home and auto insurance. A lot of insurance companies give discounts, the most common one being a discount for having more than one policy with the company. Ask for multiple quotes when your shop for insurance. Get one for individual umbrella tax policies and another for a bundle price.

If you are looking to save money on insurance, research into group rates in associations you may already be a part of. Organizations like AAA, AARP, and university alumni associations sometimes offer great insurance rates for their members. This can help you both save money and utilize the benefits of the organization that you are a part of.

Clearly explain what happened to get a quick response to your claim. Take your own pictures of the damage. Inventing a false explanation or trying to make the damage more severe will not get you more money; instead, you will end up in real legal trouble.

When purchasing insurance, make sure you buy it over the internet. Most insurance companies offer discounts for those who purchase their coverage over the internet rather than in person or over the phone. Some offer discounts between 5-15%. It may not seem like a lot at first, but it adds up over time.

Before you choose an insurance policy, be sure to shop around so you know what your options are. There are many online services which can give you quotes from a number of different insurance companies, or you can hire a private insurance broker who can give you options and help you decide which is right for you.

In order to get good rates on insurance and the best way to save money, is to shop around for different rates. Different companies use different kinds of formulas in calculating insurance rates and therefore, will have different rates depending on the individual's specifications. By shopping around, lots of money can be saved.

Save on all of your insurance policies with multiple policy discounts. If you have separate home, life, car and health insurance policies, it may be worth checking with each of your companies for quotes on your other policy types. Many insurance companies will offer a discount if you carry multiple policies with them.

When you are going to be traveling make sure that you are properly insured. You can find great deals for travel insurance with a little bit of research. This can make a huge difference if you get ill or injured while you are traveling abroad, not just financially but in emergencies, it can cut down your treatment wait times.

When you decide to go shopping for a new insurance policy, make sure you're comparing identical coverage packages. You may find a low rate offered by an insurance company, but you have to ask them what kind of coverage you will be getting and what your deductible will be to ensure it is actually saving money while getting the same coverage you currently have. Being under-insured is just as bad as paying too much for your insurance!

If you've tied the knot, add your spouse to your insurance policy. Just like a teenager is charged more because they are considered a risk, being married is a sign of stability and you will generally see your rate go down. Make sure and check with both of your insurance companies to see who will offer the better deal.

Boat insurance is a must for all motorists. This will ensure that if your boat is damaged due to certain types of incidents, you are covered for the costs to repair or replace it. This insurance coverage can also cover injury to people that might be involved, as well.

When you are trying to consider how much insurance to buy it is best to purchase as much as you can comfortably afford. This is a good idea because you would not like it if you end up having losses that exceed your coverage and the difference in the premium was just http://www.nolo.com/legal-encyclopedia/employee-rights a few dollars more.

When working with an agent or broker, take the time to satisfy yourself that the agent or broker is skilled in various forms of insurance. Most states require licensing exams and continuing education for insurance producers. Ask about these accreditations, experience in the field and any other factors that are important to you.

Do not make it a habit to file claims for things that are so small that they may be seen as frivolous. Too many insurance claims in a small period of time sends red flags to your insurance company. This may lead to them canceling your policy, and you having a hard time trying to obtain insurance in the future.

If you are newly married, examine your insurance policies closely. You may be able to save hundreds of dollars a year by combining auto insurance policies and other insurances. Pick the insurance agent who is offering the best deal and go with them. Don't waste too much time before you do this, it is best to combine right away and start saving money!

If you submit an insurance claim and it is denied, always take the time to appeal the denial. At times insurance carriers initially deny a claim and then later are willing to reconsider the claim. Unless the circumstances of your claim are specifically excluded on your policy, appealing a denial can be well worth the time and effort.

You can do several things to help lower your home insurance premiums. Installing a n alarm system that monitors for smoke, carbon monoxide and burglary may drastically reduce you home owner's premiums. Call your insurance provider and discuss how these changes may affect your premiums before making any financial decisions.

Shopping around for insurance is your best bet no matter what type you may be seeking. Some companies may offer you a better deal if you combine services, but it can never hurt to take a little extra time. You may even be able to get a lower rate if you mention that company "x" offered you a certain price rate.

As you can see, it is extremely possible to lower your insurance rates quickly and easily. By following these steps you will be excited see your insurance costs going lower and lower, and you will be able spend the money you are saving on insurance in more productive ways.

Insurance Coverage Techniques That Will Help You Maximize Your Policy

Buying or selling insurance can be very intimidating. It can easily lead to a bit of information overload because of all of the resources available to anyone not experienced. Below are some tips to assist you in getting all of this information organized to where you can start buying or selling insurance smarter.

To keep the cost of travel insurance down you should check to see what your current health insurance plan would cover. Some policies, and Medicare, don't offer any coverage if you are outside of the United States and territories, others may only cover the a fixed amount for an accident but nothing for sickness that requires hospitalization.

When involved in an insurance claim, be sure to get as many quotes as possible on your own. This will ensure that you can stand your ground versus an insurance adjuster as well as ensure you are getting a fair quote. If there is a debate, be sure to calmly confront your adjuster and assume that they are not trying to cheat you.

Save on all of your insurance policies with multiple policy discounts. If you have separate home, life, car and health insurance policies, it may be worth checking with each of your companies for quotes on your other policy types. Many insurance companies will offer a discount if you carry multiple policies with them.

Get your auto and homeowner coverage from the same insurance company. When you do this you will get a better deal on both policies than you would if you bought each policy separately. This will also help you to build a better relationship with your agent, which can come in handy if something happens where you need to use your policy.

When preparing an insurance claim, be certain to keep detailed records of all expenses paid out of pocket prior to submission. It is common for business coverage to include payments for claim preparation expenses, though homeowners may also be able to negotiate as part of their final claim settlement compensation for work done to document their losses.

If your credit score has gone up, have your insurance company rechecks your scores. Insurance companies do base part of your initial premium on your credit score. Without your permission though, they can only check it when they initially offer you coverage unless you have had a lapse of coverage. If you know your credit has gone up, having your credit rechecked could net you a reduction in your premiums.

Trust your insurance agent or find a new one. Many insurance companies offer multiple agents in a single area, so if you find yourself disliking the agent you initially chose, there is no harm in looking up a different one. Agents are professionals and should not take it personally if you move on to someone you find more agreeable.

Look for insurance bundle packages to save you money. For fixed rates, you can get motorcycle and car insurance. Many insurance companies will offer several kinds of home insurance packaged together. You should see to it that you are buying insurances that you need.

Check with the company that holds your car insurance or life insurance policies to see if they also offer renter's insurance. Many companies offer significant discounts when you hold multiple policy types with them. Don't assume that it's the best price though, make sure to always have quotes from a few companies before making umbrella company salary calculator a choice.

Once you get involved in an insurance claim it is vital to remember that your insurance company is, ultimately, a profit-motivated corporation. Keep this in mind when you deal with company representatives. Do not be adversarial, just try to understand their viewpoint and their priorities. Understanding your insurer's motivations can help you bring a claim to a mutually-satisfactory resolution.

Trust your insurance agent or find a new one. Many insurance companies offer multiple agents in a single area, so if you find yourself disliking the agent you initially chose, there is no harm in looking up a different one. Agents are professionals and should not take it personally if you move on to someone you find more agreeable.

Many employers offer insurance to their workers at a discounted price. Be aware of what your company is offering before purchasing any insurance on you own. Buying your own insurance could be a very expensive thing to do. There are many people who will take a job simply because it has outstanding health benefits.

Once you get involved in an insurance claim it is vital to remember that your insurance company is, ultimately, a profit-motivated corporation. Keep this in mind when you deal with company representatives. Do not be adversarial, just try to understand their viewpoint and their priorities. Understanding your insurer's motivations can help you bring a claim to a mutually-satisfactory resolution.

Stay with your current insurance carrier unless a competitor offers a significantly lower premium or better benefits. Often, stability with a single company leads to better rates over time and an increased likelihood that a few claims will not cause the carrier to non-renew your policy. Also, many insurance carriers consider the amount of time you spent with a prior carrier in their rating structure so jumping around may actually cost more in the long run.

Use a personal insurance agent. They may be able to help you find the right kind of coverage for you and your family. They will know the guidelines and restrictions of different policies and will be able to get the one that will cost you as much as you like and give you the coverage that you need.

If you are switching insurance companies, keep your current policy in force until your new policy is issued. This can prevent you from experiencing a lapse in coverage if there is a delay with the new company. You don't want to be without coverage because sometimes, the new company's price is not that same as the quote you were given or your application is denied.

The price is not the only thing that matters when trying to get a good insurance http://www.humanrightscommission.vic.gov.au/index.php/workers-rights provider. You want to work with a person and company that is easy to work with as well as being rather responsive, so be sure to ask around and see who has had a good experience with their company.

Shopping around for insurance is your best bet no matter what type you may be seeking. Some companies may offer you a better deal if you combine services, but it can never hurt to take a little extra time. You may even be able to get a lower rate if you mention that company "x" offered you a certain price rate.

As was stated at the beginning of the article, you want to make sure that you are well informed before picking out an insurance policy. That is why this article has provided you with vital, important tips. Use the tips in order to get the policy that fits your needs.

Usage These Tips To Discover The Very Best Insurance Coverage Options Readily Available

Who can know what the future holds? Ancient peoples relied on oracles. We rely on statistical probabilities and actuarial tables. Decisions on insurance coverage are important in our lives. Insurance provides peace of mind against the unexpected. But if a catastrophe happens, insurance may save our way of life. Here are some tips to help you make decisions about insurance.

If you are an empty-nester moving to your new home, don't take the risk of your hard-earned household items and valuables being damaged or lost in transit. Spend the money to insure your goods while they're being moved to your new empty nest. Many moving companies offer such policies, and they are well worth the incremental extra expense.

Be wary of any non-disclosure or confidentiality agreements presented to you during an insurance claim. You may unknowingly sign away your maximum benefits allowed to you. Be sure to http://www.calbar.ca.gov/Public/Pamphlets/Employee.aspx consult with a lawyer first to ensure that what you are signing is legitimate and fair for all parties.

If you have filed a claim for a major loss, remember it's the insurance company's job to minimize that claim, but it's your job to get back what you lost. You may be fortunate to work with a trustworthy, principled company, but you should understand that you and the company are effectively at cross purposes and that you need to be an advocate for recovering your own loss.

Before heading off on your own to buy insurance, check with your employer to see if they offer a company plan that may umbrella company fees work for you. Many companies use the power of their workforce size to get plans and discounts that are unreachable by the general public. The limits may be low however so study the plans carefully before making a choice.

Whatever kind of insurance you are buying, remember it is little different than any other service you purchase. Comparison shopping will help you find the best insurance deal. Just remember that insurance policies come with different and idiosyncratic terms of service. A policy that looks cheap at first glance might prove to be a bad deal after careful examination.

In cases of regional disasters, some insurance companies will send special adjusters into the area to help expedite claims for policyholders, arrange temporary housing, and begin the rebuilding process. When shopping for a new homeowner's policy, you might wish to go with a carrier that has a history of helping out like this.

Ask for quotes from several insurers and check online too. Be sure to include the same variables for accurate comparisons. You can choose to go with the lowest quote, assuming that the insurer has a good reputation for service and payment of claims, or you can bring the quotes to your present insurers to see if they will match the better rates.

When you receive a bill from your insurance provider, make sure to match it up to the Explanation of Benefits (EOB) statement you would have received earlier. Review it and confirm that you are being charged the same amount that was shown on the EOB. If the numbers don't match, contact your insurance company and find out why.

Have all your insurance coverage with one company. Most companies give you a 10% discount for having both your car and homeowners insurance with them. You can shave off up to twenty percent of the cost of your insurance premiums by doing this.

Make sure that you read and understand everything about your coverage before you get into with an insurance agent to file a claim. It is your responsibility to keep up with all of the details in case the agent misses one while you are having a talk with them.

When any insurance policy has been purchased, take some time to sit down and read the fine print. Do not automatically assume that the policy is exactly as the seller presented it to you. There may be details in the terms and conditions that were not mentioned and discourage you from keeping the product. All policies have a short cancellation period after the date of purchase just in case it is needed.

Many employers offer insurance to their workers at a discounted price. Be aware of what your company is offering before purchasing any insurance on you own. Buying your own insurance could be a very expensive thing to do. There are many people who will take a job simply because it has outstanding health benefits.

Accidents are extremely unpredictable, and that's why they're called accidents. Whether we're speaking about car insurance, home insurance or health insurance, having proper coverage is a must in an unpredictable world.

Stay with your current insurance carrier unless a competitor offers a significantly lower premium or better benefits. Often, stability with a single company leads to better rates over time and an increased likelihood that a few claims will not cause the carrier to non-renew your policy. Also, many insurance carriers consider the amount of time you spent with a prior carrier in their rating structure so jumping around may actually cost more in the long run.

Some types of coverage require pre-approval before submitting a claim. If you receive pre-approval for a claim, be sure to document the name or contact information of the person providing the approval. This helps if you later experience any problems having the claim paid or approved. Most companies record policy notes when customers call, but having a specific name to contact can make the claim process simpler.

Keep all documentation from your insurance company in a central location for ease of access. This includes copies of your policy, correspondence related to claims and any other written communication. If you receive electronic communications back up the communications to an external storage device regularly and keep the device in a secure location.

Many people do not take the time to read the paperwork that comes with your insurance policy. You must take the time to read each page of it so you will better understand what your policy is going to cover and what you are going to have to pay when you file a claim.

Shopping around for insurance is your best bet no matter what type you may be seeking. Some companies may offer you a better deal if you combine services, but it can never hurt to take a little extra time. You may even be able to get a lower rate if you mention that company "x" offered you a certain price rate.

As you learned about in the beginning of this article, the more risks you take, the more you will have to pay when it comes to insurance. Apply the advice that you have learned about insurance and you'll be happy and feel less anxious getting this task out of the way.

Ways You Can Maximize Your Insurance Coverage

No one wants to pay premiums on any kind of insurance without knowing what they are getting contractor umbrella companies for it. There are all sorts of things that an average person does not know when it comes to insurance. The following article will help you learn some important information in order to get what you pay for.

If you are looking to save money on insurance, research into group rates in associations you may already be a part of. Organizations like AAA, AARP, and university alumni associations sometimes offer great insurance rates for their members. This can help you both save money and utilize the benefits of the organization that you are a part of.

When you have found a company to insure you, find out if that company is covered and licensed under the state's guaranty fund. This fund will pay claims in case your insurance company defaults. Check with your state insurance department and they will be able to provide you with more information.

It's always a good idea to shop around for the best insurance rates, but remember, if you do decide to change insurers, have your old policy and your new policy overlap by a few days. Don't let there be any uninsured time between policies. This is a big risk in terms of the possibility of having a traffic accident or getting a ticket while uninsured.

If you are a small business owner, you must make sure that you have all of your insurance needs covered, to protect you and your business. One thing that you should have is E&O insurance, which is better known as Errors and Omissions business coverage. This insurance protects your business from customer lawsuits.

To find the best deals on your insurance, compare how much different insurance companies will charge you. You can find reviews and quotes online or at your local state insurance department. Once you settle for an insurance company, do not hesitate to switch over to another one, if the price increases.

Always document your claims and keep accurate records. This will make your claim experience smoother. Make sure you document all conversations you have with your insurance company in order to know the progress of the claim. Follow up on any face-to-face or phone conversations with written letters to confirm what they tell you.

Keep your credit in good standing, and it will reflect on your required premiums by giving you lower rates. Many insurance companies include credit history in their calculations when figuring your insurance rates. If credit agencies list you as a really risky, insurance companies are going to follow suit and inflate your premiums to protect themselves.

If you're planning on switching insurance providers, make sure you open your new policy BEFORE canceling your old one. If you cancel your policy first you could find yourself uninsured at the worst possible time, leaving you uncovered and paying for the situation yourself. Saving money isn't worth the risk!

Get endorsements for your valuables. For example, you will want to take your valuable jewelry to a jeweler and have an appraisal done on it. You then must provide your insurance company with that appraisal. This will prove that you indeed did have the item in question and how much it was worth so you can be paid for http://www.contractorumbrella.com/calculator.html the actual value of the item.

Your insurance agent is always available to help you lower your insurance costs, so give him a call. He is well versed on all of the various discounts offered by your insurance company, so he can help you figure out every possible way to reduce your premiums and increase your coverage.

Private insurance plans can run you thousands of dollars per year, so make sure that you tweak your policy to your particular needs. You might have a nest egg saved up and are not worried about ample coverage, but you also need to make sure your kids are fully covered. Split the difference here, and save the money.

Search out trustworthy companies that have good rates before you purchase insurance. There are a many websites that will provide you with valuable information about various insurance companies. Ratings and rankings on customer satisfaction for many national insurance companies are available online from JD Power. The NAIC website can provide you with lots of information on complaints filed against insurance companies. If you are curious about how established any particular company is, look it up on ambest.com.

Ensure that you receive fast payments in the event of insurance claims through the use of endorsements. Endorsements that prove the value of your most valuable property, such as expensive jewelry, pieces or artwork or state-of-the-art video equipment, are obtained and provided by you to your insurance company. In the event of a fire, flood or anything that results in your property being damaged, stolen or lost, you can receive payouts to cover the cost much quicker, when the specific items are endorsed.

Keep all documentation from your insurance company in a central location for ease of access. This includes copies of your policy, correspondence related to claims and any other written communication. If you receive electronic communications back up the communications to an external storage device regularly and keep the device in a secure location.

Grouping your insurance policies together is a great way to save money in the long-term. If you combine your auto, health and home insurance, you should be able to save thousands of dollars over the life of your policy. Just make sure you're choosing a great company to handle your policy.

One great tip when trying to purchase insurance is to comparison shop. Meaning check out all the companies that are out there and what they have to offer and how much they are expecting you to pay. Some companies offer the exact same thing but have completely different prices. Also check with your friends and the yellow pages and even your state's insurance insurance department for more options and information.

Shopping around for insurance is your best bet no matter what type you may be seeking. Some companies may offer you a better deal if you combine services, but it can never hurt to take a little extra time. You may even be able to get a lower rate if you mention that company "x" offered you a certain price rate.

Hopefully, these tips have provided you with some very valuable information, as well as given you a way to organize all of the information you may have already had on buying or selling insurance. Keeping these tips in mind can help you become an expert about insurance policies.

Insurance Coverage Tips: Preparing For The Unforeseen

In today's risky world, having some kind of insurance is pretty much accepted as compulsory- you need it to drive a car, or buy a home. However, for smaller items or fields that don't require it, it's not always clear whether insurance is worth the investment or not. This article contains some hints and ideas for helping you make sense of insurance and will suggest what schemes would best suit you.

When selecting a company that sells travel insurance, always go with a third-party company. While many airlines and cruises sell travel insurance, it is most likely designed to protect the company offering the trip, not the consumer. Travel insurance is a great investment, but only if it works for you.

When you are getting an insurance quote make sure to tell them anything and everything that may qualify you for a discount. For instance, high school might have been ten years ago, but you were an honor student and that qualifies you for a discount. Another thing that qualified me for a discount was that I work in the medical field, so be sure to tell them where you work. We all love saving money, so be sure to ask about all possible discounts.

When dealing with an insurance claim, be sure to keep accurate logs of the time and money that you spent on preparing the information needed for your claim. You may be entitled to a reimbursement for time spent. It is possible that you may need to hire help, or it may also be possible that you lose work time when preparing the claim.

If you are aging and worry about your income, you should purchase a disability income insurance. If you become unable to work, your insurance will give you enough money to support yourself and your family. This kind of insurance is relatively cheap and secures your financial future no matter what happens.

Get your auto and homeowner coverage from the same insurance company. When you do this you will get a better deal on both policies than you would if you bought each policy separately. This will also help you to build a better relationship with your agent, which can come in handy if something happens where you need to use your policy.

Small business owners need to insure more than just the building in which they operate. They also need to insure any special tools or equipment used in the conduct of their business. A business owner's equipment and tools are considered personal property and are not normally included in the coverage provision of most business liability policies. Therefore, they must be protected against loss, theft or damage, with a separate policy.

In cases of regional disasters, some insurance companies will send special adjusters into the area to help expedite claims for policyholders, arrange temporary housing, and begin the rebuilding process. When shopping for a new homeowner's policy, you might wish to go with a carrier that has a history of helping out like this.

When selecting your insurance coverage, be aware of your assets. People with more assets to protect, especially homeowners, should have more insurance coverage than people with fewer assets. This is because if you are underinsured for your auto, for example, and you get into a major accident that causes hundreds of thousands of dollars in damage, you could end up liable for those damages and lose your assets.

If you feel that you are paying too much for your renter's insurance premiums, you may want to check with your insurance company to find out if the place that you are renting is considered to be a high risk structure. The higher premiums may be due to the fact that the building that you are renting is high risk and the cost is being passed on to you.

If you are a member of a union or other important group, make sure to tell your insurance agent. Many insurance companies will offer steep discounts for certain groups, so you should ask your umbrella company fees agent if yours does as well. You do not want to miss out on taking advantage of great benefits.

Consider signing up for a decreasing term insurance program. This type of insurance is designed to supplement your investments if you were to pass away before the investments reach a certain level. The higher the investment grows, the more affordable the monthly premium becomes. With this type of insurance you will save money over the life of your policy.

The best time to switch insurance providers is when your policy is up for renewal. Canceling a policy at the end of it's term means you won't have to pay a cancellation fee, which saves you money. You also can let your current insurer know that you plan on canceling and http://www.investopedia.com/terms/t/tax-umbrella.asp moving to another insurance company and they may offer you a discount to match the new company's offer, or even better it.

Consider buying a renter's insurance policy after renting your new place. This policy doesn't cover the structure of the home, but pays for your belongings. Take pictures of your furniture, books, jewelry, CD and DVD collection, TV and electronics, so you can prove to the insurance company that you owned them.

Having any kind of insurance can be a life saver. From getting into wrecks in your vehicle, to having a health problem, you can save a lot of money by being prepared beforehand. Usually there is a monthly payment, but it pales in comparison to just walking into a doctor without insurance. Sometimes a doctor's visit without any kind of insurance costs more than you pay a year in insurance!

When selecting insurance, it is important to remember the deductible. A deductible is an amount that must be paid from your own money before an insurance company pays any other expenses. A lower deductible means that you won't have to pay as much for the insurance company to cover your expenses.

You should try to quit smoking before you apply for any type of health or life insurance. Insurance companies charge heftier premiums to those that smoke. Being a non-smoker can save you a ton of money. If you have a hard time quitting, many health companies will lower your premiums after you successfully complete a smoking cessation program.

Shopping around for insurance is your best bet no matter what type you may be seeking. Some companies may offer you a better deal if you combine services, but it can never hurt to take a little extra time. You may even be able to get a lower rate if you mention that company "x" offered you a certain price rate.

You can learn so much more about insurance and find out how to really find the rates that you are interested in, which will give you a break in premiums. However, if you don't take the time to do the research needed, you could lose out on great information that you could use to get much lower rates. Take these tips and others to mind and get a search started with the right strategy.

The Most Vital Tips Around For General Insurance!

Insurance is a form of risk management. It is used mostly, to prevent the risk of a loss. An insurance agent will sell you the type of insurance that you feel is best for you. The more risk factors you have, the more you probably will need to pay. This article will give you many tips about insurance.

When selecting a company that sells travel insurance, always go with a third-party company. While many airlines and cruises sell travel insurance, it is most likely designed to protect the company offering the trip, not the consumer. Travel insurance is a great investment, but only if it works for you.

When you are filing a claim with an insurance company, ask for your claim number at the end of the original conversation with your agent. Write down and keep this number for reference. Any time you call for an update on your claim, you'll need this number, so it's better to have it on hand.

When dealing with an insurance claim, be sure to keep accurate logs of the time and money that you spent on preparing the information needed for your claim. You may be entitled to a reimbursement for time spent. It is possible that you may need to hire help, or it may also be possible that you lose work time when preparing the claim.

One of the best ways to save money on insurance is by maintaining a good credit score. Most insurance companies these personal service company days take into account the customer's credit score as part of the calculation done for insurance rates. With that said, maintaining a good credit score could help save money.

Check into your health insurance coverage. You want to be sure that you will be covered in the event of an injury or an illness. The last thing that you would like to happen was to get badly injured and not have any medical insurance to cover the expense of care.

When shopping for coverage, make sure to get quotes from multiple insurers and for different plans within a particular company. The prices of insurance plans vary wildly and you could be missing out on saving hundreds of dollars a year by not shopping around. Consider working with an insurance broker, who can help you understand your various options.

If you have filed a claim for a major loss, remember it's the insurance company's job to minimize that claim, but it's your job to get back what you lost. You may http://www.umbrellacompanies.org.uk/tag/tax-avoidance/ be fortunate to work with a trustworthy, principled company, but you should understand that you and the company are effectively at cross purposes and that you need to be an advocate for recovering your own loss.

Your friends and coworkers may be able to offer useful information about their experiences with local insurance providers. You can find both bad and good experiences and be able to better choose a company you want to work with.

Check with the company that you get your other insurances from, like rental insurance and life, to see if they offer a policy for car insurance. Most companies will offer you a discount for purchasing multiple policies from them. It may not be the cheapest option so you still need to get quotes from elsewhere to be sure.

Private insurance plans can run you thousands of dollars per year, so make sure that you tweak your policy to your particular needs. You might have a nest egg saved up and are not worried about ample coverage, but you also need to make sure your kids are fully covered. Split the difference here, and save the money.

If you are consolidating your insurance policies, make sure you're approaching this as wisely as possible. There is a good chance that you will inadvertently, create areas of insurance overlap or gaps in coverage. Consult a broker to assist you if you're not sure how to group things together to save money.

Prior to buying an insurance policy, shop around and compare companies and rates. You can gather information on insurers from multiple websites on the Internet. Ratings and rankings on customer satisfaction for many national insurance companies are available online from JD Power. The National Association of Insurance Commissioners website can give you information on any complaints filed against a company. You can find more information at ambest.com as well.

If you have recently paid off your mortgage, contact your insurance agent and ask if they will lower your premiums. This is a frequent insurance company practice for homeowners who are no longer making monthly mortgage payments. It is believed that policy holders take better care of their property if they are the sole owner.

Often, you will wish to consult other customer reviews of certain insurance companies before investing your money in their policies. By consulting websites like Angie's list and other such user comments, you can gain a sense of the current public opinion toward an insurance company. If most of the company's patrons are satisfied, that may help you form a decision, and vice-versa.

Do not make it a habit to file claims for things that are so small that they may be seen as frivolous. Too many insurance claims in a small period of time sends red flags to your insurance company. This may lead to them canceling your policy, and you having a hard time trying to obtain insurance in the future.

Do not try to overstate the value of any of your property while you are in the process of filing an insurance claim. Insurance adjusters have been trained to spot the value of certain things and it will make them red flag your claim if you are claiming that something has more worth than it does.

Shopping around for insurance is your best bet no matter what type you may be seeking. Some companies may offer you a better deal if you combine services, but it can never hurt to take a little extra time. You may even be able to get a lower rate if you mention that company "x" offered you a certain price rate.

Insurance can be incredibly confusing. Hopefully, the tips on this site have helped you better understand how to buy insurance the right way. Apply the tips you have learned today to get your insurance situation under control. Do not make your insurance any more confusing than it has to be.

Affordable Insurance Can Be Within Your Reaches

We all need insurance for so many different things in our lives. We insure our homes, our cars, our health and even our lives. With so many different types of insurance out there - for so many different reasons - it can be difficult to keep it straight! This article will give you some advice on how to do it right!

Look into multiple insurance policy discounts. When you bundle your insurance contracts with one company, you will often get a discount of 10% or more. If you currently have home insurance with a company that you are satisfied with, contact them and get a quote for auto or life insurance. You may find that you will get a discount on every policy.

When involved in an insurance claim, always be as professional as possible. The people you are working with are people too, and you will see much more positive results if you are positive and professional. Your insurance company only wants to know the facts, not the emotions. Proofread all written material sent to them.

To http://www.1stcontact-umbrella.com/resources/umbrella-tax-calculator make sure your insurance is providing the coverage that you are paying for make sure that you talk to your agent when you make any large purchase. Most policies have limits for any single item. If you buy a new ring that is worth $5,000 you may need to add an endorsement to cover it fully.

If you want insurance companies to deal fairly with you, then you must do the same for them. You might be tempted to pump up your claim or say you lost more than you did, but if you do this, you will add fuel to their concerns about claimant fraud and they are less likely to deal with you in an honest way. It's the Golden Rule, once again: report your loss fairly and honestly, with all the details needed, and accept what appears to be fair value (if in fact that is what you're offered).

When filing a claim with your insurance company, be proactive about getting updates and information about your claim status. If you simply wait for the insurance company to tell you how much they owe you, you could be in for a very long wait. As they say, the squeaky wheel gets the grease.

You should consider purchasing renter's insurance for your apartment. You certainly own valuables hmrc umbrella companies and other personal possessions, which would need to be replaced at your own expense if anything should happen to them. In this event, you should take out a personal property policy, which will cover your possessions and valuables.

Every year, go through your insurance coverage to make sure it is still appropriate to your needs. There are times when you may need, or want, to drop one specific option or insurance company and move to another in order to save money or increase protection. If there have been changes in your family size or medical needs, you may want to adjust your insurance accordingly.

Make your insurance premium one of the first payments you make every month. Most polices have language written into them that a missed payment cancels your insurance coverage. This can be especially dangerous as your health or risk status may have changed since you first purchased your insurance. A lapse in coverage will end up meaning higher premium payments so make it a priority.

Determine whether you actually need to include towing in the price of your automobile policy. One tow is approximately a hundred dollars, but after a few years of insurance premiums, you will have paid much more than that in insurance costs. Other parts of your policy will cover tow charges in case of an accident, so you are really paying for something unlikely to be used.

Pre-paying your insurance bill can save you money on your premium. Insurance companies prefer for you to pay your insurance in a lump-sum and will reward you for saving them time and money on the costs of sending you bills. You can save payment plan fees of up to 3%!

Avoid signing-up for insurance policies that guarantee you will be approved. These types of insurance are much more expensive than a regular policy because they cannot manage the risk levels of their policy holders. Unless you are in bad health and have been turned down elsewhere, avoid these types of policies.

Avoid paying high commissions to an agent for your insurance coverage. With all of the different ways to buy insurance these days, don't waste some of your hard earned money paying out a commission. Do your research and purchase directly from the insurance company to get the best deals.

Make sure that you read and understand everything about your coverage before you get into with an insurance agent to file a claim. It is your responsibility to keep up with all of the details in case the agent misses one while you are having a talk with them.

Work toward having good commercial credit. The lower your credit score, the "riskier" you appear to be to insurance companies. You will get a much better rate on commercial insurance if your credit score is good. Pay attention to the total amount of debt you have and always pay your bills as soon as they come in.

Consider working with an insurance broker to identify your specific insurance needs. Most insurance brokers work with a variety of carriers and policy types, enabling them to suggest an appropriate package of insurance policies matching your unique financial and family situation. Whether you need property insurance, life insurance or specialty insurance, a broker can help identify the correct products for you.

When filing a claim be sure to be completely honest with the insurance agent even if the situation is embarrassing to you. Not being totally honest can lead the agent you speak with to invalidate your insurance policy altogether, or red flag the account and deny your entire insurance claim.

If you are financing your home or vehicle, the financing company you are working with might require you to get a certain type of coverage. When you set up a financing plan, go over insurance requirements carefully with them. Go over your policies together if you want to make sure you are properly insured.

Your insurance experience will be better if you employ just a few of these ideas. The more you learn, the better you will be at finding great deals and avoiding nasty pitfalls. Everyone needs to buy insurance, but not everyone learns how to do it right. Educating yourself translates directly into better insurance for less money.

Why Do Companies Ask Certain Interview Questions

Although we are in tough economic times, it is not impossible to find a job. The following article is full of great tips you can use to increase your chances of finally finding work. Put them to good use and remain optimistic; you'll never get hired without the right attitude!

Getting a job in today's economy isn't easy. However, if you learn good interviewing skills, you should be able to land a job in no time. Be sure to look your interviewer in the eyes, and give good, sincere responses. You will then not be surprised when you get a call that you got the job.

Go the extra mile to make things easier for your boss. For example, if you know that your boss likes to have coffee when he arrives in the morning it is a great gesture to ensure that a pot is ready when he usually arrives. Little things like that can decide how you are perceived by your boss.

Make certain that you bring a list of your references with you on the day of the interview if you did not already list them on your resume. This list will help the interviewer get an idea of the person you are, as your references should include names and telephone numbers for follow-up.

If you are having problems finding a job in the town you live in, you may need to look in the next town over. It may be a hassle to have to travel elsewhere everyday, but jobs are not so easy to come by. Even if you do work in the next town over, you can continue to look in your town as well.

Before you even apply for a job, be sure that your resume is as up-to-date as possible. List any past job that you can think of, as trivial as a job may seem The more experience you have in a specific industry, the more likely you are to land a job.

Turn down the number of rings on the phone you use for job searching to five. This allows you plenty of time to get to the phone, but doesn't have so many hmrc umbrella companies rings that potential employers will hang up before they get to the answering machine, causing you to lose out on an opportunity.

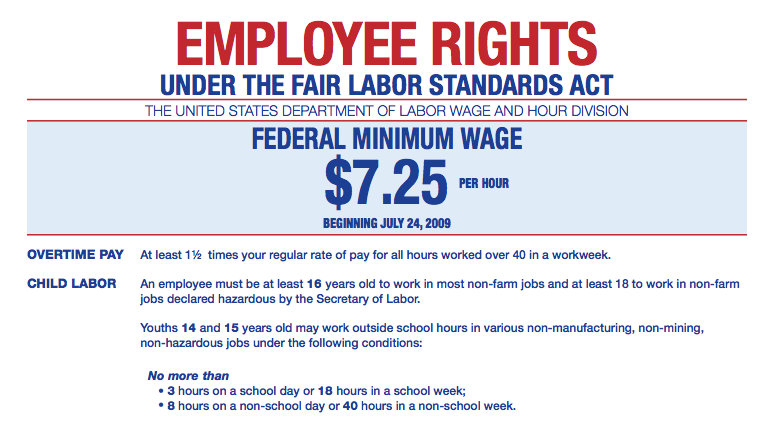

If you are an employer looking to save a little when tax time comes, and you have a job that is pretty simple consider hiring a disabled worker. The federal government offers all sorts of tax benefits and advantages to doing so. This will save you a ton of money, and at the same time; the work is still getting done!

Take the time to write a quality cover letter before applying for a job. Your cover letter is a reflection of your communication and writing skills. Do your best to describe your experience in details, talk about your motivations and explain why you would be a good fit for the job.

When looking for a job, consider shifting industries. If you are in between jobs, that is usually the best time to make a change. If you have been working in sales, for example, now might be the best time to shift to real estate. Look for ways to use your skillset in new ways, and that will expand the list of possible jobs for you.

Get to the interview 10 minutes before the appointed time. This will help you center yourself before the interview and show you're serious about the position. There is absolutely no reason for you to be even 5 minutes late. If you are late, have a really good explanation ready before you let the interview continue.

When searching for a job online, it's always a good idea to make sure you utilize the good tools you find to build your resume. You're going to need the help when it comes to how competitive the market is online. You need to think of ways your resume can stand out and grab http://www.futurelinkgroup.co.uk/contractor/payroll-solutions/umbrella-payroll people's attnetion.

As tempting as it may be to create an ornate resume, keep it as professional as you can. Do not use colored paper or a different type of font thinking that it may stand out. This will come across as too flashy, as companies will simply toss these to the side.

When using the search function to look for jobs, you want plenty of filters provided so that the search results that pop up are compatible with your needs. You don't want to have to weed through bad results. Make sure that you have plenty of filters available for selection.

Make sure your references know they are your references. Don't use a college professor from 10 years ago on a whim. When companies contact your references, your references need to know to expect those calls and emails so they are looking out for them. Not only that, but wouldn't you also appreciate a heads up that someone might call you?

Try doing some volunteer work in your desired field. This type of knowledge-seeking is often overlooked, but it can both make you feel good and help you acquire important industry knowledge first-hand. It also provides you with a great opportunity to network with other professionals. Prospective employers tend to look favorably upon volunteer work listed on your resume, as well.

When you do temporary work, work hard to make a good impression. Sometimes a short-term job can turn into a long-term one if you make yourself stand out as a superior worker. An employer will often use a temp job as an alternate way of interviewing prospective employees, so always perform at your best level.

Keep your resume to one page. For the majority of people, a resume one page long is enough to get your story across. Longer resumes have a tendency of getting trashed before ever getting considered. So unless you've got a wealth of experience that just can't fit on a single page, aim for brevity.

You will have better chances of finding a job if you are willing to relocate. Do some research on the job market you are interested in and find out which areas are more dynamic than others. Do some research on the cost of living in these areas and ask yourself whether or not you want to relocate.

Everyone gets nervous when they are applying for a new job, but having the right information can help you feel a bit more prepared. As stated earlier, there are things you should and should not do while on an interview. Hopefully this article has helped you shed some light on the subject.

Why Do Companies Ask Certain Interview Questions

The state of the economy has financially crippled many. Now being less financially stable than ever you are terrified. Luckily, the article below has some helpful tips that can help you land your next job. Use the advice in this piece and get back into the work world.

If you're writing a resume, try picking a format that suits the position you want. There are many types of common formats like a chronological, targeted, or combination resume. Take some time to see what works best for you. If possible, try to create your own format that gets your information across in a clear and concise manner.

Bring several copies of your resume with you on the day of your interview. This is very important as you will need this to present to the person interviewing you. Also, you can look over your resume before the meet, as a lot of the questions will come off of this document.

When it comes to your coworkers and managers, remember to keep your personal and professional lives separate. It's smart to stay professional at all times with the people you come into contact with. When you have friendly and personal relationships at work, you can introduce confilicts that are not work related into the workplace. It will serve you well to keep things professional at all times.

The best plan for getting a job in the field of your choice is to educate yourself adequately. Think carefully about which type of job holds the greatest interest for you, and which line of work you possess the most ability to do. When you have the proper credentials, finding the job you want will be much easier.

Prior to going for an interview for a job, it is helpful to know as much as you can about the company. When doing an interview, if you are able to talk with the interviewer about their company, it will make it look as you are very interested in working for them. Do your research by asking around about them or looking them up online.

Speak with your friends and acquaintances from college to see if you can leverage off of your contact list to find a job. You will be surprised just how far the branch extends with the people that you know to all of the companies that are in your line of work.

Although you may be unemployed, right off the bat, you will need to make finding a job your full-time job. Prepare yourself to devote at least forty hours a week to finding employment, and try to stick to a consistent schedule as much as possible. This will help you avoid falling into the 'I'll look for a job tomorrow' trap.

Do not always trust jobs you see on the Internet. While certain sites are safe, other sites, such as Criagslist, have many scammers that not only are false employers, but are looking to take your money. The best way to go job hunting is by asking people you can trust or by going to establishments to ask if they are hiring.

Take the cash out for sick and vacation days if it is offered. If you want to earn as much as you can at this stage in your career this is a great way to do so. Remember that everyone does need a break from time to time, but not likely as much as you are given.

If a full-time job is not readily available, consider working part-time as a contractor in your field for the time being. This may get your foot in the door with a company. Recruiters also do not like to see huge time gaps http://vrta.org/data/article_umbtax in an applicant's employment history. So, working part-time can make that gap smaller.

When in a new position, try to over-communicate with your employer rather than under-communicate. Many employment issues stem from a lack of communication; this can lead to distrust and worse. There is no harm in frequently communicating more than the expected amount. You may just find that your manager appreciates what you have to share about your position in the way of feedback and questions.

Make sure that the voicemail on your phone sounds professional if you are giving your number to potential employers. Avoid loud background music and distracting noises. You should be clear about who you are and politely ask the caller to leave a message. Make sure that you return every call you receive promptly.

If your company sponsors volunteer opportunities for its employees to participate in, get involved. This will expand your network of business contacts within your company. The more people know who you are, the easier it will be for you to move around in your company. Including this experience in your resume will also show that you are a well-rounded person, which is a good trait in an employee.

Before any interview practice answering questions you may think will pop up. You don't want to be thrown for a loop during an important interview! Write out the ten toughest questions you think they may ask and really craft out good answers. This way you'll be ready with a good answer in case the question is asked.

When you are going on an interview, come alone. If you have a child, make sure that you take care of the babysitter in advance. You will need to focus on your interview and your interview alone, as other people will just shift your focus away from what really matters.

When you do temporary work, work hard to make a good impression. Sometimes a short-term job can turn into a long-term one if you make yourself stand out as a superior worker. An employer will often use a temp job as an alternate way of interviewing prospective employees, so always perform at your best level.

Keep up with new technology if you are trying to find a job in this economy. Nobody is going to hire you if you can't at least operate the latest equipment and navigate the lingo. You don't have to go back to college, just immerse yourself in the technology until you are comfortable with it and can honestly list umbrella companies in uk it on your resume!

You will have better chances of finding a job if you are willing to relocate. Do some research on the job market you are interested in and find out which areas are more dynamic than others. Do some research on the cost of living in these areas and ask yourself whether or not you want to relocate.

As you continue searching for a job, remember the advice from this article. Form a plan to get through everything. You will need to stick to your guns and be diligent, but it will be much better than trying to wade your way through a confused mess! Your job hunt will go much better when you know what you plan to do!

Support And Motivation To Keep Control Of Your Money

Making sound personal financial decisions, these days, is essential if you hope to see a better tomorrow. So, in this day and age, just how does one manage to budget, save and prepare? It's actually not as difficult as you might think. There are a few important rules to consider but if you follow them, financial security can be yours.

Avoid thinking that you cannot afford to save up for an emergency fund because you barely have enough to meet daily expenses. The truth is that you cannot afford not to have one. An emergency fund can save you if you ever lose your current source of income. Even saving a little every month for emergencies can add up to a helpful amount when you need it.

Minimize your credit card accounts to just one account. Having more than one card can lead to difficulties in managing your monthly payments. Typically most people spend on cards that are available and with multiples you run the risk of outstripping your ability to cover all the payments necessary to maintain your due dates.

Minimize your credit card accounts to just one account. Having more than one card can lead to difficulties in managing your monthly payments. Typically most people spend on cards that are available and with multiples you run the risk of outstripping your ability to cover all the payments necessary to maintain your due dates.

Make sure to always pay yourself first. You should be putting at least 10% of your pre-tax income into a savings account. This is the money that is going to keep you from losing the house during an emergency. Do not skip on it and do not forget about it.

If you work in the city, try to refrain from purchasing magazines on newsstands. This will cost you a lot of money on something that you can simply find by logging on to the internet. Eliminate rash spending such as this, in order to reduce your expenses and increase your bank account.

If http://employment.findlaw.com/ you are a college student, make sure that you sell your books at the end of the semester. Often, you will have a lot of students at your school in need of the books that are in your possession. Also, you can put these books online and get a large percentage of what you originally paid for them.

Flea markets can often be a productive way for one to supplement their personal finances. An individual can purchase goods for a cheaper price than they would pay in stores or they can sell items at the flea market for a financial gain. However a person wants to use them, flea markets are beneficial for personal finances.

It is never too early to teach children about personal finance and savings. If they earn an allowance, have them set aside a percentage into a piggy bank or a savings account (if they're old enough to have one). They can also do the same with money they receive for birthdays or holidays.

If you are having trouble with money, apply for a credit card at your local bank. Credit cards are very valuable as they allow you additional time to pay back the money that you owe and can go a https://bitly.com/u/gregdickson long way in establishing a firm credit score for benefits in the future.

Be willing to shop around at banks. One bank might have a better interest rate, another credit union might have free checking that works out better for you. Don't be afraid to have multiple accounts to take advantage of all the promotional offers that you are eligible for. But look around.

It can be much, much easier to get into debt without realizing it if we are paying by credit card versus paying by cash. Because of high interest rates, we often end up paying much, much more when we pay by credit card than we would if we used cash.

Watch for letters that tell you about changes in your credit accounts. By law, you should receive at minimum a forty-five day notice. You must decide if you will be keeping the account after the changes. If they are not, then close it!

Don't order your checks through your bank! Most banks charge a pretty hefty fee for printing your checks because they aren't the actual printer. They are financial institutions but they are just a middle man when it comes to printing. Look for ads in the Sunday inserts to find a cheap check printer.

Avoid using "alternative financial services" as a substitute for traditional banking. This includes services such as rent-to-own stores and payday loans. These places extend credit at extremely high effective interest rates, which makes it very difficult to keep up with the payments. This ultimately means you will lose money in the form of fees (payday loans) or losing your equity in the property (rent-to-own).

If you are trying to save money or need to tighten your budget, consider these tips to lower your monthly bills. Raise the deductible on your car insurance, downgrade your cell phone plan and cut out eating out. These three things may save you a couple of hundred dollars immediately.

It is always a smart financial move to make yearly contributions to an approved Individual Retirement Account. It will allow you to be more financially secure in the future. Interested parties can open up an IRA with a credit union, brokerage firm, bank, or even a mutual fund company. Regular contributions will make sure that your retirement is comfortable and secure.

If you're a student looking to start college, you should try as hard as you can to avoid student loans. Your personal finances will never be the same with this debt looming over your head. Always check out grants instead of loans. You won't have to repay these. And although it may put a strain on you, you could always work and pay your way through school. It's better than being 200k in debt when you enter the workforce.